It sounds like Discoveryco. may be a reality.

Warner Bros. Discovery is “moving towards…a split,” CNBC’s David Faber reported on Thursday, in a news update that broke right after the company’s quarterly earnings results and call with Wall Street analysts. Faber added, “and it’s become relatively clear to me from the many conversations that I’ve had that we could get some sort of an announcement in the not-too-distant future that they are planning to try to split the company.”

Faber said that is “almost definitely” will see the Warner Bros. studios paired with Max, leaving WBD’s cable networks as the odd assets out. It’s basically exactly what NBCUniversal is doing to Faber.

A spokesperson for Warner Bros. Discovery did not immediately respond to The Hollywood Reporter’s request for comment on the Faber report.

NBCU is spinning off most of its cable assets — minus Bravo and including CNBC — into a new company now called Versant (fka “SpinCo.”) and led by Mark Lazarus. Digital assets like the Golf Now app, Rotten Tomatoes and Fandango will also be part of Versant. Almost immediately after the original announcement of SpinCo., media analysts and reporters began to ask when Warner Bros. Discovery will do the same — and will Skydance Paramount do the same immediately after that merger clears? Disney CEO Bob Iger had publicly said in July 2023 that his studio’s legacy TV networks, including ABC, “may not be core” to the company; he’s since walked that back.

In December, WBD began reorganizing its corporate structure into a global linear TV division, separate from its streaming and studios division. The new corporate structure aims to bolster its “strategic flexibility and create potential opportunities to unlock additional shareholder value,” per a company filing at the time. The initiative is expected to be complete in mid-2025 — guess what part of 2025 we’re approaching?

“They’ve already done all of the reapportioning necessary,” Faber said. “And I would note as well, in their earnings report, for the first time, they break out every segment in its own financials. That is usually a tell, right? Streaming has its own page, studios and linear, global linear segments, network segment as well.”

So what is WBD waiting for? Well, it’s still got like $35 billion in debt to appropriate across Warner Bros. core and Discovery.

“It will take quite some time to actually happen,” Faber said.

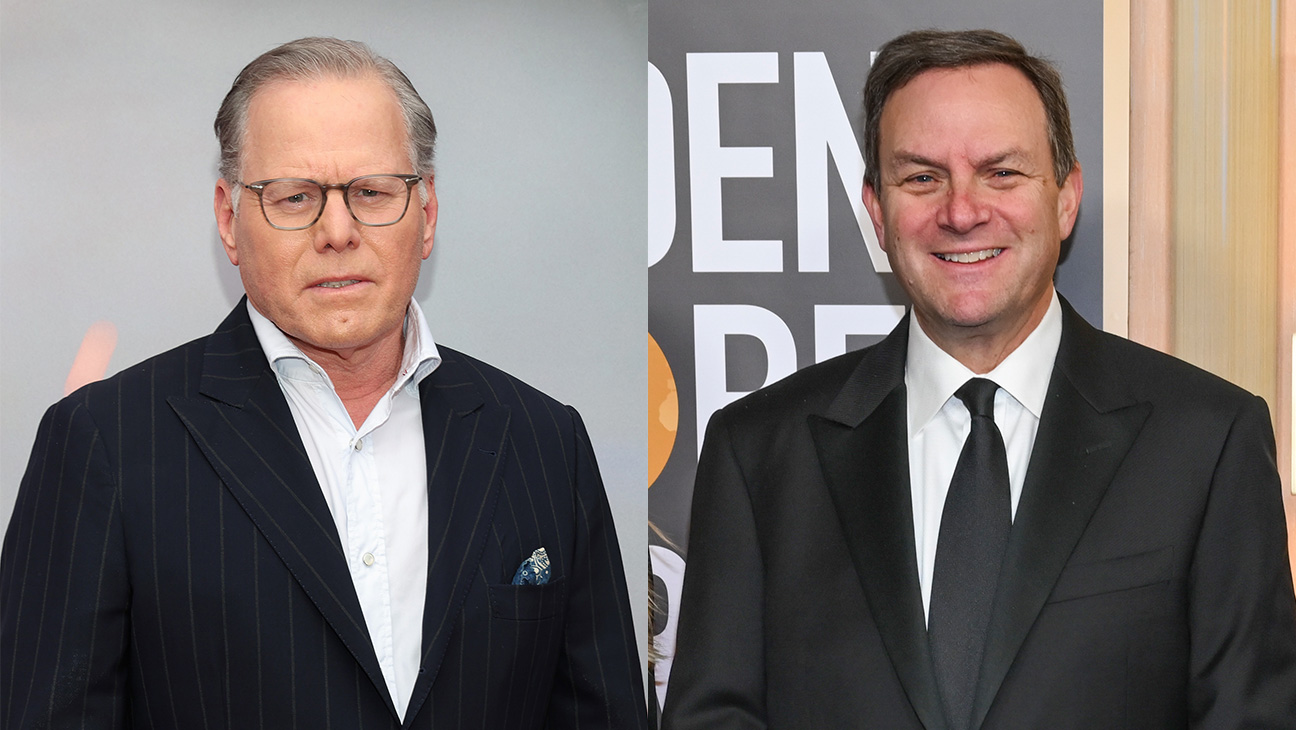

WBD was formed just a few years ago as a combination of David Zaslav’s Discovery, Inc. and AT&T’s WarnerMedia.